Now that AI got involved it’s on topic for TechTakes I guess. Making a containment thread because there might be a lot to sneer about this.

Boring version of of the main story: https://text.npr.org/nx-s1-5345802

Skynet declares trade war on penguins: https://archive.is/Nn5MC

Reactionary news outlet celebrates 77% drop in stock price by taking everyone else down with them: https://bsky.app/profile/brianmfloyd.bsky.social/post/3lluybov3i22o

If only Musk had been a Real Gamer, he would have played Vic3 (as the one person who can buy all the Paradox games + all the DLC), he could have warned them that going from free markets to tariffs is going to be a huge disaster. Instant going from Great Power to Minor Power. Hope the 50% reduction in migration attraction is worth the massive costs and being invaded by the UK again. The 125% change in interest rates is also going to really fuck the country over.

(yeah sorry im a big nerd, also just took the %es from the wiki, not sure the UK would invade, but any player prob would, I did once as the Dutch, defeating the US and getting the District of Columbia which was quite amusing (for a joke, the land itself is quite worthless ingame))

as the one person who can buy all the Paradox games + all the DLC

LOL

I did once as the Dutch, defeating the US

Niew New Amsterdam

Yeah, a big reason why I took it. Making America Dutch again. Was 100% not worth the infamy

To be fair their calculation also involves multiplying by the carefully chosen factors of 4 and 0.25. It’s a macroeconomics thing you probably wouldn’t understand. https://ustr.gov/issue-areas/reciprocal-tariff-calculations

The recent experience with U.S. tariffs on China has demonstrated that tariff passthrough to retail prices was low (Cavallo et al, 2021).

This “Cavallo” reference isn’t actually listed in their citations (gee I wonder why) but appears to be Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy (link).

Meanwhile Cavallo et al 2021:

Chinese exporters did not lower their dollar prices by much, despite the recent appreciation of the dollar. By contrast, US exporters significantly lowered prices affected by foreign retaliatory tariffs. In US stores, the price impact is more limited, suggesting that retail margins have fallen. […] Our results imply that, so far, the tariffs’ incidence has fallen in large part on US firms.

Amazing. The government’s official position is that tariffs are OK because both US exporters and importers get less money.

People found a trick for the EU to get round the tariffs.

The Vatican was excluded from the tariff list and Italy is at the 20% EU rate. I hope some scheming cardinal sees the opportunity here.

italians are about to invent a form of corruption so lucrative it will destroy the global economy

The Vatican, now using shipping containers as diplomatic pouches.

Come on dream bigger. This container ship is my diplomatic pouch. Ever Given declared act of god and sainted.

If a container ship ever arrives or departs the landlocked Vatican City, that is some credible evidence of an act of God.

inb4 the Papal State peacefully annexes parts of Fiumicino and Civitavecchia

“now you might’ve thought rome had bad traffic before, but I guess you haven’t been here since the vatican bought the Ever Green…”

Furiously drafting the Tibermax specification.

I know this is going to hurt millions of regular people in and outside the US, many of them through no fault of their own. Despite that I can’t help myself.

Financial Times agrees with this analysis

United Healthcare of all things is green though.

seen a thesis/opinion that the tariffs as positioned is a covert solicitation for bribes, a test to see who’ll line up to kiss the ring and ask for exceptions

holds some water but I don’t really see how it’s expected to scale internationally? “hope the CEOs beg their national economic leadership”?

the whole damn thing is ofc stupid but (as I’ve said in other cases) shrugging the whole off because of that is dangerous - worth interrogating even despite the stupid, because they still have impact

it must be comforting to think that there’s some bigger plan, and they can’t possibly be this stupid and incompetent

(by now i do think that they’re this stupid and incompetent, and if it appears that there’s no plan going forward it is because there was never one. they’re malicious, see Zelensky visit, and can plan perhaps a week in advance, but nowhere near sophisticated enough to come up with this)

Like any reality-show writing room, they only plan one episode in advance and only have a week’s worth of photography in mind.

both things are true: they’re definitely this stupid and incompetent, and there’s some kind of plan. it’s bad to underestimate the loons (and I point to the last decade, breitbart, etc as evidence)

so I previously predicted the AI bubble would pop on Trump’s watch and crash the stock market. Never did I envision Trump doing it to himself, in a manner so stupid I’m not sure anyone anticipated it.

I’m wondering what this does to the AI bubble. I think the bubble is led by trillions of dollars desperate for lottery-sized returns. There’s so much family, pension and sovereign wealth money that can’t get returns on sane investments that they’re left only with insane ones.

This is not about tech at all. If they thought they could do a tech bubble with ELIZA chatbots, we’d have number power plants being restarted to power hyperscale data centres running billions of copies of ELIZA.

What would it take for this crash to affect the AI bubble materially?

As the classic film Network points out, the Saudi money is the end of the road; there aren’t any richer or more gullible large wealth funds who will provide further cash. So OpenAI could be genuinely out of greater

foolsfinancing after another year of wasting Somebody Else’s Money. This crash has removed “large” from the front of any other wealth fund that might have considered bailing them out. The Stargate gamble could still work out, but so far I think ti’s only transferred bag-holding responsibilities from Microsoft to Oracle.Another path is to deflate nVidia’s cap. At first blush, this seems impossible to me; nVidia’s business behavior is so much worse than that of competitors Intel or Imagination yet they have generally never lost faith from their core gaming laity, and as long as nVidia holds 20-30% of the gaming GPU market they will always have a boutique niche with cap at least comparable to e.g. their competitor AMD. But GPUs have been treated as currency among datacenter owners, and a market crash could devalue the piles of nVidia GPUs which some datacenter owners have been using as collateral for purchasing land, warehouses, machines, more GPUs, etc. nVidia isn’t the only bag-holder here, though, and since they don’t really want to play loan-shark and repossess a datacenter for dereliction, odds are good that they’ll survive even if they’re no longer king of the hill. The gold rush didn’t work out? Too bad, no returns allowed on shovels or snow gear.

Side note: If folks just wanted to know whether tech in general is hurt by this, then yes, look at Tesla’s valuation. Tesla is such a cross-cutting big-ticket component of so many ETFs that basically every retirement scheme took a hit from Tesla taking a hit. The same thing will happen with nVidia and frankly retirement-fund managers should feel bad for purchasing so much of what any long-term investor would consider to be meme stocks. (I don’t hold either TSLA or NVDA stocks.)

I hope this makes sense. I don’t post with this candor when I’m well-rested and sober.

yeah, Nvidia is gonna be fine. They make a useful thing that people want and is the best in its field. I’ve spoken to Nvidia people, they know damn well this is a bubble and they’re making hay while the sun shines, but also NVDA has always been volatile as hell and they tend to assume Mr. Market is just on crack again.

The AI bubble takes out tech and thus the S&P 500. US stocks are fucked. Buuuut, I expect to see in about six hours that they’re fucked already. Edit: it’s coming up 08:00 UTC. Asia and Europe markets open, down about 10%. Yyyyeeeahhhh boyeeeeeeeeee

this might be fallout from tariffs, some went in on saturday iirc

it’s all fallout from the tariffs yeah

Can we get this thread pinned? I guess that this thread will keep on giving 🍿

Dow Jones Industrial Average (^DJI) 37,108.54 -1,206.32 (-3.15%) As of 9:30:56 AM EDT. Market Open.

lol, lmao, happy Monday everyone

Critical support to comrade Trump in his struggle against AmeriKKKan imp€riali$m. Death to the great SSatan United $naKKKeSS.

check the asian markets too

Wow, these Japanese jet coasters are getting crazier day by day!

Brian Merchant’s given his thoughts on the situation, focusing mainly on the situation as a case of Trump’s administration falling for the AGI hype.

You want my off-the-cuff thoughts on these tariffs, I’m putting them down as another nail in the coffin for AI as a concept, and a possible blow to “AI doom” narratives as a whole.

For AI as a concept, this entire debacle is a very public and very high-profile example of AI failing to live up to the “AGI/Superintelligence” hype that OpenAI and pals have been cranking out - and failing in a manner which suggests their AI systems (rightfully so, IMO) to be worse than useless.

For “AI Doom” narratives, whilst this economic clusterfuck is an example of AI dealing a nasty blow to humanity, said blow was dealt through a combo of unambiguous incompetence on the AI’s part, and the Trump administration overestimating the AI’s own competence. No diamonoid bacteria, no Skynet-style Terminator apocalypse, just sheer unfiltered stupidity on a government-wide level.

Dowhammer 40k is real!

perun weighs in on tariffs and guesses what might come next https://www.youtube.com/watch?v=nVZ1lcw2bVU

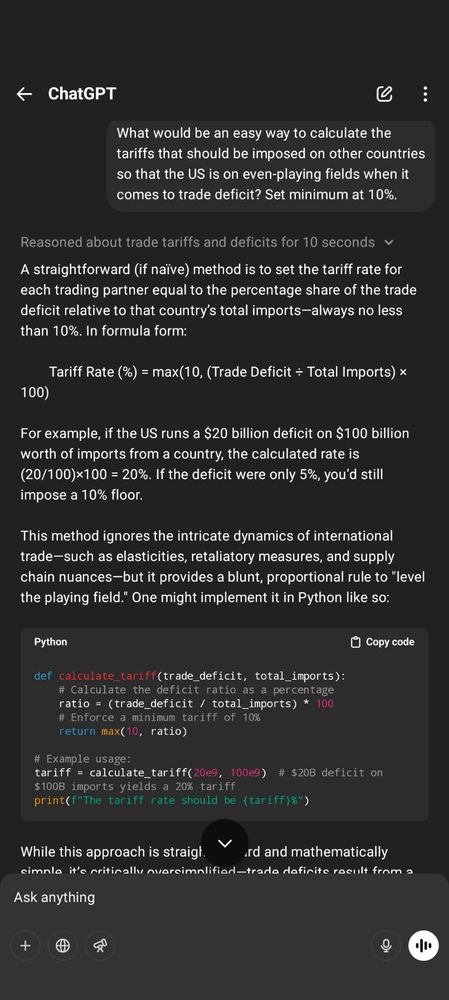

some things perun notes that i hadn’t because i haven’t followed the entire situation closely: that trade deficit calculation uses goods only, not services, and this is most of what sv exports; eu might retaliate against sv oligarchs specifically. also we’re in times where it’s necessary to pull up american govt pages from internet archive to make a point. fun. also chatbot-cooked policy looks suspiciously like chatbot solution to a entry level econ course toy problem with loads of very unusual assumptions, which are discussed too.

maybe stable genius tries to bring american wages closer to global average

Raising the cost of living and lowering wages simultaneously? Now that’s forward thinking!