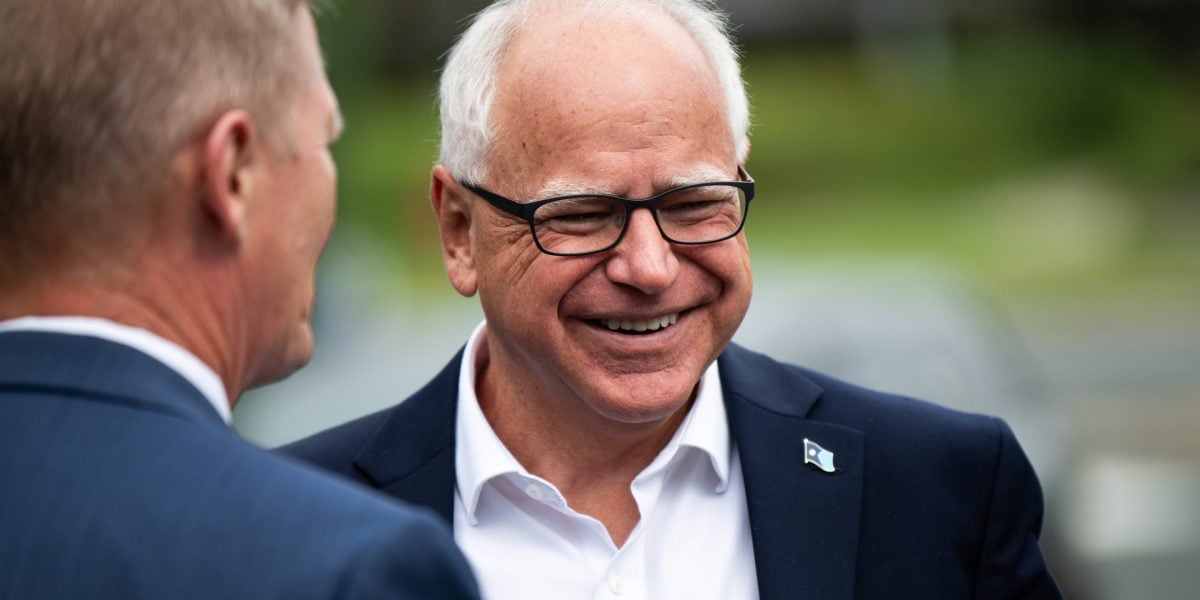

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

You’re missing the forest for the trees here.

And who lists income streams in their net worth?

Can you explain?

I realize the point of the article is that he isn’t some wealthy elite like the vast majoring of politicians. I think if one wishes to drive this point to everyone, one should not leave out details that would allow someone to dismiss it entirely no matter how wrong they would be for dismissing it.

I’m not saying it should be dismissed. Perhaps I wasn’t clear about that. I’m looking at it from the perspective of trying to change or win minds. And I think it’s best to include a more complete picture even if the additional details do not change the picture much if at all.

They said his net worth. You’re upset about not talking about his pension. You don’t list your pension in your net worth, just like you don’t list your take home pay in your net worth. Your net worth is the total after adding up your total assets and subtracting your debts/obligations.

If this is new information to you then I apologize for my tone in the other comments. The point is there is nothing omitted or neglected. This number is accurate as-is.

I’m not upset. The other commentor might be. But I’m not.

I guess I always thought you included retirement accounts in net worth because they carry a cash value even if it hasn’t been cashed out yet. Just like you would include shares in a company in someone’s net worth even if they hadn’t sold the shares.

Perhaps pensions are slightly different. Everyone I work with who opted for the pension over a 401k includes their pension in their net worth and, to my understanding, so do the financial planners that work with the Union.

A pension is not a retirement account, it’s an income stream. It’s completely different from 401k’s.

It’s not an investment account, it’s payment. The institution keeps paying you at regular intervals after you’ve left. As an income stream it is not part of your net worth, just like folks’ hourly wages/salary are not part of their net worth. Social security is another example - not net worth, not an investment account, but an income stream delivered at regular intervals.