Do you remember the username? I would like to see the dunks

Thanks for sharing!

Unless you look for companies that are not on the blacklist but in a geostrstegic industry. You’d still have the risk that they could end up on the blacklist…

I don’t want to go into very specifics for various reasons, but can elaborate on the approach/process and thinking. Also the risk involved.

We are in decades weeks times and there’s a lot of geopolitical shifts happening. This means lots of investment/speculation opportunities. Dialectical and historical materialism let’s you understand the laws governing these shifts and helps you find investment opportunities easier™ (This felt soo dirty to type lol)

Following the news mega and reading the coping and seething in WSJ, CSIS, FT etc. articles in regards to China, reading our comrades very insightful comments to contextualize I have been able to get a sense of what industries are interesting to look at.

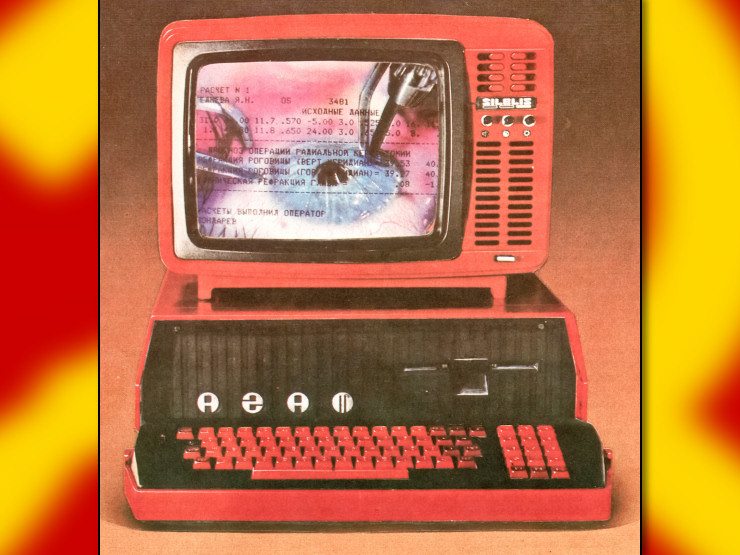

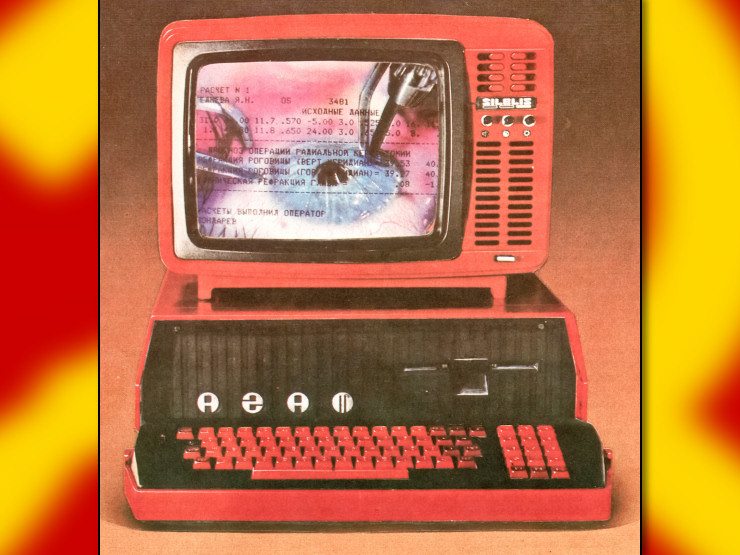

As a starting point I took the US entity list/blacklist of Chinese companies that you’re not allowed to trade. Since I’m euro based, this doesn’t apply to me so I took it from there. Must be a reason why they’re forbidden fruit, right? This is a major risk though. Euros are cucked by US foreign policy and might follow suit. Your assets can be frozen, stock can be worthless, etc.

First of all it’ll require lots of reading and research on the industry/company you’d like to invest in. Find out what they’re making and what their strategy is. Also take into consideration what the CPCs strategy is i.e. don’t buy evergrande when the CPC has been signaling not to

Once you have a pick (ideally basket of picks to diversify risk), stick with it for 3-5 years. Any news that comes out will have a major impact on the stock price, so you’ll need to have nerves of steel. You’re not doing day trading after all (which is pure casino).

There’s significant financial risks involved, so be prepared to lose it all. Just look at the Russian sanctions how far things can go. The geopolitical rift between china and the US is heating up so never know how it can go.

Good luck

I’m ready to get dunked on but here we go

I’m engaging in speculative trading (meaning: buying and holding stocks for 3-5 years) and betting on the rise of a multipolar world. In practice this mean for me: I pick a stock in the Chinese market that I think will eventually outperform a western company (e.g. EV, semiconductor, fusion, renewables, etc. - actually I picked a company that’s on the US blacklist) and buy an amount where I’m ready to lose the money (I’m aware of the privilege) and just hold it. I follow the news mega so I get a good dose of financial press to keep up.

So much brainworms in the comments

Thank you for your response. It makes sense.

My questions stems from the observations that: On one side: Trump was the first to introduce (economic) hostilities with China via tariffs (which got expanded under Biden) Conservatives who are into trump, and uncritically are into Putin (“traditional values”) Conservatives who are into hawks like Mearsheimer (who’s basically saying war with Ukraine bad, war with China in US interest)

And on the other side: Ukraine happening under Biden (Albeit as you mentioned, looking for the best opportunity to dump Ukraine now). Neolibs while not being particularly interested currently, at least are supportive of Ukraine.

Thus I made the connection: Trump = war with China (or at least doing another stupid first escalatory move similarly to raising the tariffs; Saying/doing the quiet part out loud) and Biden = war with Russia (albeit your response corrected that, I def see them trying to withdraw from there as well)

Spreading them thin and financially drain the reserves. With dedollarization picking up pace  's plan might work this time around lel

's plan might work this time around lel

Is it fair to compare Biden vs Trump as the vote between war with Russia vs. war with China? (i.e. each candidate representing a different faction of hawks)

The only one that is saying this is you

I vote  because I agree it’s a fun bit

because I agree it’s a fun bit

I’ve seen a lot of user vote using  vs

vs  . How is that vote counted?

. How is that vote counted?

Top 5 Countries That Produce the Most Semiconductors: Taiwan South Korea Japan United States China

China is listed as the largest and 5th largest in your source

China has ranked first in the share of published papers since 2017, the top 10% most-cited papers since 2018 and the top 1% since 2019.

Moving the goalposts as a coping mechanism

https://www.wipo.int/pressroom/en/articles/2023/article_0013.html

fuck interlectual property in general, so even if China did steal IP from other countries (it didn’t), I’d respect them even more

Cope lib

China retains crown in scientific papers, widens lead over U.S. https://archive.md/BFUU0

Ah so an enlightened centrist then?

Antideutsche libs when will they learn