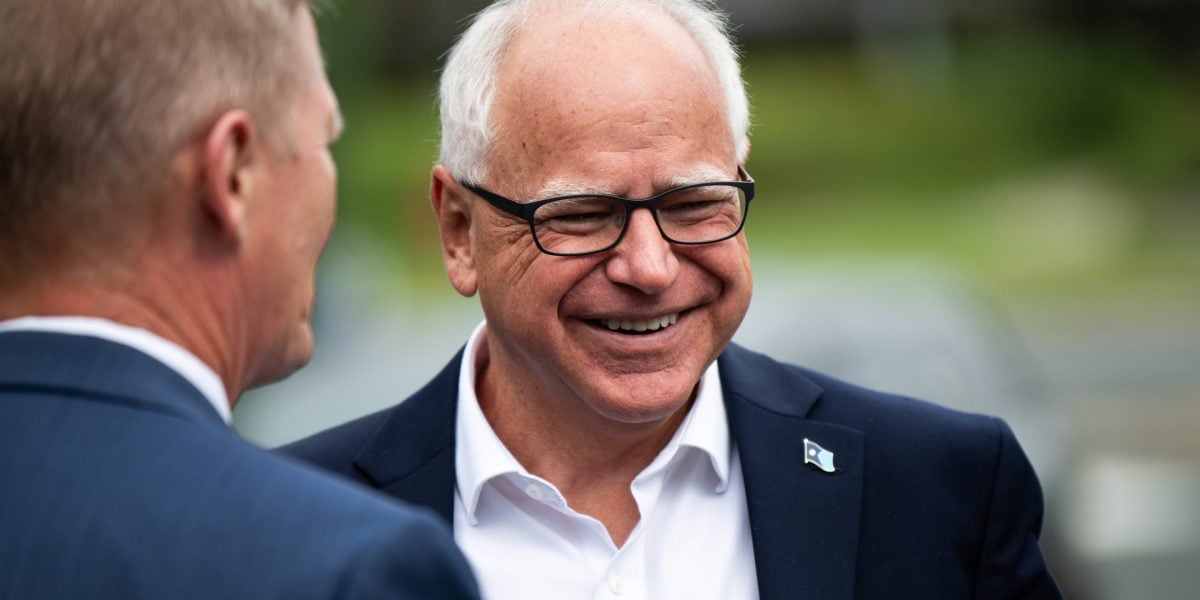

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

Only the portion of a pension income that is not spent is included as a part of net worth. Given the average expenses of a 60 year old and the piss poor pension of the average schoolteacher, I imagine there would hardly be any money of his pension that isn’t spent and is considered part of his net worth, no?

If I had an investment account that would give me $10k per year, it would be worth about $125k. If I was entitled to $10k a year through a pension, wouldnt it be fair to say that entitlement is an asset that’s worth (at least a portion of) that same value?

Is that money being spent, or saved? If it’s being spent in a year on regular expenses, how would that contribute to net worth?

Most peoples’ pension is spent, not saved, because it’s meant to replace their working income in order to allow them to pay the bills. In Walz’ case, is it at all similar to the example you gave? Like come on, let’s not enter fluentinfinance levels of hypotheticals.

The debate isn’t whether the money is equal to something invested, income is simply not calculated in net worth. A pension is income.

The article also states their household income, which would include said pension. Nothing is obfuscated here.